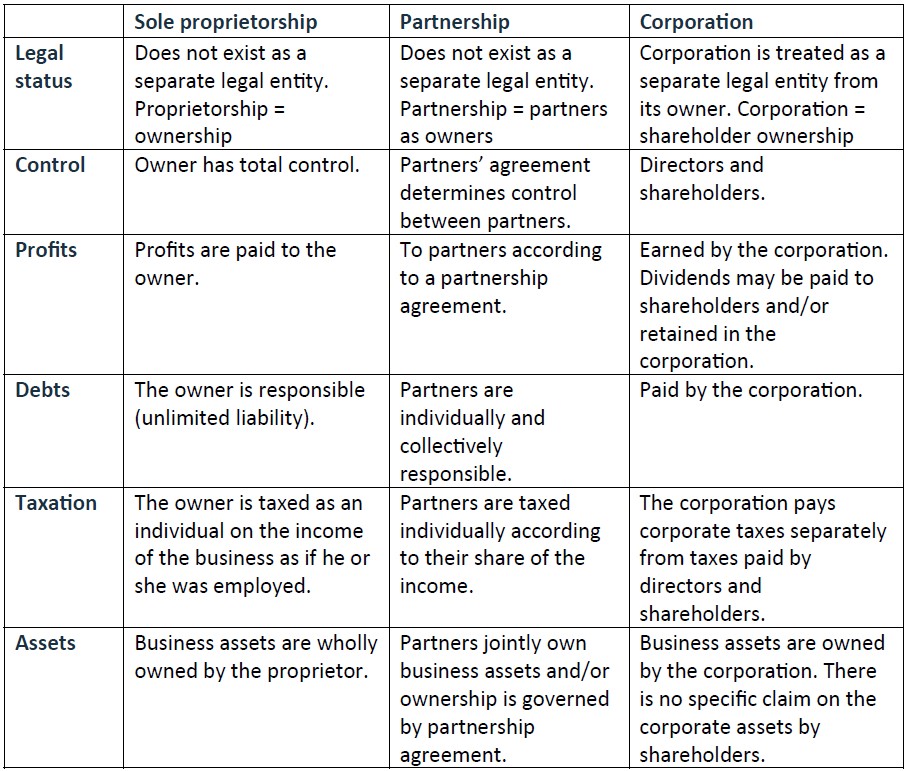

There are three types of legal structures for a business: a) sole proprietorship b) partnership

(which is a form of proprietorship) and c) corporation

When incorporating, you create a new legal entity called a corporation. In Canada, a corporation has the same rights as a person

Benefits of incorporating

Federal incorporation offers many benefits, including:

- The right to use your name across Canada

- Limited liability

- Lower corporate tax rates

- Better access to capital and grants.

Corporations Canada is the country’s federal corporate regulator. It administers the laws that allow Canadians to create and maintain a corporation under the federal laws governing Corporations in Canada. Note that the Office of the Superintendent of Financial Institutions incorporates financial institutions.

Corporations Canada is responsible for the administrating the:

- Canada Business Corporations Act

- Canada Not-for-profit Corporations Act

- Boards of Trade Act

- Canada Cooperatives Act.

It is responsible for compliance activities under these laws, as well as for registering railway

deposits and issuing official documents under the Great Seal of Canada.

An annual return is a document that all “active” corporations are required to file with Corporations Canada every year under federal legislation. The annual return provides Corporations Canada with up-to-date information on the corporation. An “active” corporation is a corporation that is not dissolved, amalgamated with another corporation or continued into another jurisdiction.

- An annual return is not the same thing as a tax return, which must be filed with the Canada Revenue Agency.

- An annual return must be filed within 60 days of the anniversary date of the corporation — the date on which the corporation was incorporated, amalgamated with another corporation or continued into an act administered by Corporations Canada.

The anniversary date of a corporation is the date on which the corporation was incorporated, amalgamated with another corporation or continued into an act administered by Corporations Canada. An active corporation must file its annual return within 60 days of its anniversary date. Corporations can sign up to receive annual return reminder emails.

Corporations Canada has the power to dissolve a corporation that has not filed its annual returns. Dissolution can have serious repercussions on corporations, including not having the legal capacity to conduct business and losing their charitable status.

You can find the anniversary date of a corporation on Search for a Federal Corporation.

The deadline for filing an annual return is within the 60 days following a corporation’s anniversary date. The anniversary date is the date your corporation incorporated, amalgamated or continued under the CBCA . You do not file for the year the corporation was incorporated, amalgamated or continued.

The date can be found on your corporation’s Certificate of Incorporation, Amalgamation or Continuance. You can also find your anniversary date on Corporations Canada’s online database.

An “active” corporation means that the corporation is not dissolved, amalgamated with another corporation or continued into another jurisdiction. Corporations can sign up to receive annual return reminder emails.

Corporations Canada has the power to dissolve a corporation that has not filed its annual returns. Dissolution can have serious repercussions on corporations, including not having the legal capacity to conduct business and losing their charitable status.

You can find the status of a corporation (active, inactive, etc.) on Search for a Federal Corporation.

Federal corporations will likely have to register in any province or territory where they carry on business. Registration is different from incorporation. A corporation may incorporate only once, but it can register to carry on business in any number of jurisdictions.

A corporate name is the legal name of your corporation. This name identifies your corporation, and you must use it in all contracts and invoices. It can be a word name or a numbered name (for example, 12345678 Canada Inc.).

Remember: your corporate name is different from a trademark or domain name. Owning a domain name does not automatically mean that it can be your corporate name.

Word name

A word name can include letters, symbols and numbers. It has to be distinctive and must not cause confusion with other names or trademarks. The name also cannot include prohibited terms.

Corporations Canada reviews all proposed corporate word names to ensure they comply. For more information, see Obtaining a word name.

Numbered name

Only business and not-for-profit corporations can have numbered names (assigned by Corporations Canada). You can use a different name to operate your business (for example, the name you use on your storefront, website or business cards).

Your corporate name can be one of the following:

- English only

- French only

- English and French (separate)

- English and French (combined)

A corporation key is a password. The corporation number along with a corporation key allows you to complete some online transactions. You can find it on the ‘Corporate Information Sheet’, sent by email on your date of incorporation

You’ll also need a 9-digit Business Number (BN). A BN is required in order to start an account with the Canadian Revenue Agency (CRA), which is essential for how your business is taxed. You may need to file for a new business number if you change the legal ownership or structure of your business, but you’ll also need one to get off the ground. A business number is also essential if your business is federally incorporated or if you register for CRA program accounts.

You need a business number if you incorporate or need a CRA program account.

You might need a business number to interact with other federal, provincial, and municipal governments in Canada.

Certain business activities require a business number. You can register for:

- A business number: a unique, 9-digit number and the standard identifier for businesses which is unique to a business or legal entity

- Canada Revenue Agency (CRA) program accounts: two letters and four digits attached to a business number and used for specific business activities that must be reported to the CRA

Directors are responsible for supervising the activities of the corporation and for making decisions regarding those activities. Officers are responsible for the day-to-day operation of the corporation.

Your corporation must have at least one director. The number of directors is specified in your articles of incorporation. Shareholders elect directors at the shareholders’ meeting by a majority of votes. An individual can be the sole shareholder, director and officer of a corporation.

Canadian residency

Ordinarily, at least 25 percent of the directors of a corporation must be resident Canadians. If a corporation has fewer than four directors, however, at least one of them must be a resident Canadian. In addition, corporations operating in sectors subject to ownership restrictions (such as airlines and telecommunications) or corporations in certain cultural sectors (such as book retailing, video or film distribution) must have a majority of resident Canadian directors.

A director must:

- be at least 18 years old

- not have been declared incapable under the laws of a Canadian province or territory, or by a court in a jurisdiction outside of Canada

- be an individual (a corporation cannot be a director)

- not be in bankrupt status

A corporate minute book is essentially a collection of all important corporate records, including the articles of incorporation, which the corporation’s shareholders and creditors can access. A minute book may be a physical binder containing all of the required documents, or your corporation may choose to keep its corporate minute book online for easy sharing.

- A well-maintained corporate minute book prevents disputes as decisions and ownership percentages are well documented

- The corporation’s accountants and the Canada Revenue Agency may need to review your corporate records.

A corporation is required to maintain records to be viewed by shareholders and creditors upon request. The required documents include:

- Articles of amendment

- Bylaws and amendments

- Unanimous shareholder agreements

- Minutes of meetings and shareholder resolutions

- Notices filed

- A share register with shareholder names and addresses and details of the shares held

- A securities register

Collecting all documents at your disposal is the first thing the Corporation’s Directors can do when attempting to fix a minute book. Once all the documents are collected, the deficiencies can be examined. When helping clients prepare a corporate minute book, I set up the following electronic folders with the following contents. The Corporation’s Directors should collect the documents for every folder. Should they not be able to locate them, the Corporation’s Directors should collect all documents that can provide evidence of the category, such as emails or notes.

Corporate Articles

This includes articles of incorporation, articles of amendment (if any), including amended articles of incorporation or restated articles of incorporation. The Articles of Incorporation is a legal document submitted to the Provincial or federal government that establishes a business within Canada. If they cannot be located, a copy can be obtained from Corporations Canada for Federal Corporation.

Corporate By-laws

This includes by-laws and their amendments. By-laws are rules that govern the internal operations of a corporation. The federal government provides some model By-laws for companies.

Directors Register

This is a document that lists the Name of a Director, their residential address, whether they are a Canadian resident, the date they became a director and if applicable the date they ceased to be a director. A sample Directors Register Template is available for download. Directors Register Template

Forms Filed

Forms filed are all the documents that have be filed with government entities (Corporations Canada or Ontario’s Government and Consumer Services). These can be ordered from Corporations Canada for Federal Corporations. For example, these forms include:

- CBCA Form 2 – Initial Registered Office Address and First Board of Directors

- CBCA Form 3 – Change of Registered Office Address

- CBCA Form 6 – Changes Regarding Directors

- CBCA Form 22 – Annual Return

- Form 4 – Application for Termination of Extra-Provincial License

Notices and Resignation

Notices sent out for all Director and Shareholder meetings. Any director change in address or Director Resignation.

Officers Register

This is a document that lists the Name of an Officer, their residential address, the date they became an Officer and if applicable the date they ceased to be an Officer. Some typical officers of a Corporation are President, Vice-President, Treasurer and Secretary. A sample Officers Register Template is available for download. Officers Register Template

Resolutions and Minutes

These include all Director Resolutions, Shareholder Resolutions, Minutes of a Directors Meeting, and Minutes of a Shareholders Meeting. This would also include consent to act as Director.

Share Certificates

Typically, a share certificate will have a certificate part and a stub part. The Certificate should remain with the holder and stub part should remain in the corporate minute book. The stub part should list all the information on the share certificate.

Shareholders Ledger

A Shareholder Leger lists the holdings of each specific shareholder. For each shareholder, a ledger would be created listing the date they received shares, the certificate number, the transfer number, to or from whom the shares were transferred, the number of shares sold or purchased and the balance of shares that they have. A sample Shareholders Ledger Template is available for download. Shareholders Ledger Template

Shareholder Register

A Shareholder register shows the names and addresses of all shareholders and details of shares held. A sample Shareholder Register Template is available for download. Shareholder Register Template

Transfers Register

A Transfer Register details the transfer number, the date the transfer occurred, the certificate number, the number of shares transferred, to and from whom the shares were transferred from, and the number of shares transferred. A sample Transfers Register Template is available for download. Transfers Register Template

Debt Obligations Ledger

A record of all debt obligations should be kept. If a corporation is an OBCA company, a Register of Interests in land in Ontario should also be kept in the corporate minute book. A sample Debt Obligation is available for download. Debt Obligation Ledger Template

Shareholder Agreement

A complete shareholder agreement is a document that specifies the rights and regulations of shareholders in a corporation. If one exists, it should be included in the minute book.

Individuals with Significant Control Register

For Canada (CBCA) Corporations, a register of individuals with significant control needs to be maintained. This register is a document that contains information about individuals with significant control. More information on this new requirement can be found in the video below. Individuals with Significant Control Register Template

Corporations Canada is responsible for the administration of the following laws:

- Business Corporations Act

- Not-for-profit Corporations Act

- Canada Corporations Act

- Boards of Trade Act

- Canada Cooperatives Act.

The registered office of a company is the location where documents (often notice of a lawsuit) must be served on the company to be effectively served or to meet the requirements of the Business Corporations Act. The location of a registered office must be open during regular business hours Monday through Friday.

Care should be taken when selecting a registered office because there are often time limits for replying to notices of lawsuits and if a company fails to respond within the required time period, then the applicant may apply for a judgment without further notice to the company.

The records office of a company is the location where the records of the company are held as required by the Business Corporations Act.

Care should be taken when selecting a records office because if a person who is entitled to obtain a list, to inspect a record or to receive a copy of a record from the records office of a given company, makes a request and the corresponding records office fails to comply with such request, then, on notice to the company, an application may be made to the Corporate Registrar for an order. Without limiting the power of the Corporate Registrar, the court may, on application, make the order it considers appropriate and may without limitation order the company to pay to the person who requested the record damages in an amount that the court considers appropriate.

Yes, a company may change its registered and records offices at any time by agreement of the directors. There are filings with the Corporate Registrar that must be completed to document a change of registered and records offices of a company.

Corporate records and record office

A corporation is required to keep certain records at its registered office or at some other location in Canada chosen by the board of directors. These records must include the following:

- all articles of the corporation, (for ex., articles of incorporation, art icles of continuance or articles of amalgamation); by-laws and their amendments; and unanimous members agreements

- minutes of meetings of members and committees of members

- resolutions of members and committees of members

- if any debt obligations are issued by the corporation, a debt obligations register showing: the name and residential or business address of each debt obligation holder; an email address, if the debt obligation holder has consented to receiving information or documents electronically; the date on which each person named in the register became a debt obligation holder; the date on which each person named in the register ceased to be a debt obligation holder; and the principal amount of each of the outstanding debt obligations of each debt obligation holder

- a directors register showing: the name and residential address of each director; an email address, if the director has consented to receiving information or documents electronically; the date on which each person named in the register became a director; and the date on which each person named in the register ceased to be a director

- an officers register showing: the name and residential address of each officer; an email address, if the officer has consented to receiving information or documents electronically; the date on which each person named in the register became an officer; and the date on which each person named in the register ceased to be an officer

- a members register showing: the name and residential or business address of each member; an email address, if the member has consented to receiving information or documents electronically; the date on which each person named in the register became a member; the date on which each person named in the register ceased to be a member; and the class or group of membership of each member, if any.

In addition, the corporation must prepare and maintain minutes of meetings and resolutions adopted by the directors and committee of directors.

The records described in (a) to (g) above, together with the accounting records, must be open to inspection by the directors at all reasonable times. In addition, following a request from a director, the corporation must provide the director with any extract of the records free of charge.

Upon request, a member, a member’s personal representative, and a creditor (for ex., a landlord or supplier) may examine the records referred to in (a) to (f) above and may, on payment of a reasonable fee, obtain copies of such records during the corporation’s usual business hours.

Also, upon request, a member is entitled to receive, free of charge, one copy of the articles and by-laws, as well as amendments to these documents and any unanimous members agreements. If a member wishes to examine a corporation’s register of its members (referred to in (g) above), or the debt obligations register that lists debt obligation holders, or to obtain a list of members or debt obligation holders, additional requirements must be met (see Your reporting obligations under the Canada Not-for-profit Corporations Act; you can also refer to subsections 22(4) to (7) of the Canada Not-for-profit Corporations Act (NFP Act)).

You’ll also need to decide whether to apply for a GST/HST number. Most businesses with revenues under $30,000 per year are defined as a small supplier and thus don’t need to collect GST/HST, but you’ll have to register if your revenues total $30,000 in one calendar quarter or in four consecutive quarters